The UK economy may have shrunk in the fourth quarter, putting Britain back on the brink of recession and piling more pressure on Chancellor Rachel Reeves and her promise to turbocharge growth.

Article content

(Bloomberg) — The UK economy may have shrunk in the fourth quarter, putting Britain back on the brink of recession and piling more pressure on Chancellor Rachel Reeves and her promise to turbocharge growth.

Article content

Article content

Economists reckon GDP fell 0.1% following a stagnant third quarter, amid the fallout from Reeves’ tax-raising budget. With surveys pointing to a slow start to 2025, the Bank of England estimates there is a 40% chance that Britain is already in a technical recession — two consecutive quarters of contraction — for the second time in just over a year.

Advertisement 2

Article content

Flat-lining growth and renewed cost-of-living pressures are deepening the problems facing Reeves ahead of new official forecasts next month. The Office for Budget Responsibility is now set to follow the BOE by downgrading its economic projections, raising the prospect that the chancellor will have to cut spending on public services or welfare to avoid breaking her fiscal rules.

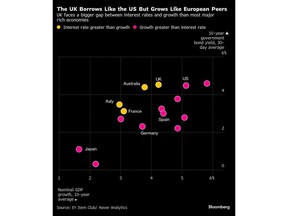

The UK is facing the worst of both worlds. Government borrowing costs are akin to those in the fast-expanding US economy but growth is closer to the struggling eurozone, where the European Central Bank has slashed interest rates to well below UK levels. It makes stabilizing the public finances a particular challenge for Reeves, with investors already jittery about a government debt mountain that’s the highest as a share of the economy since the early 1960s.

According to EY Item Club calculations, Britain pays more to borrow relative to its nominal growth rates than most advanced economies.

“Unless governments manage to reduce their sizeable primary deficits, market concerns about public-sector debt sustainability are likely to grow,” said Ruth Gregory, deputy chief UK economist at Capital Economics. “This means there is little room for complacency.” A primary deficit is the amount a government need to borrow to fund its spending excluding debt-interest costs.

Article content

Advertisement 3

Article content

The Office for National Statistics is due to announce fourth-quarter GDP figures on Thursday, along with a new estimate for December alone. Bloomberg Economics reckons output stagnated during the month, leaving the economy no bigger than when Labour took office seven months ago. Consumers and businesses are continuing to reel from the £40 billion ($49.5 billion) of tax increases announced in the budget and threats to the world economy from tariffs being imposed by US President Donald Trump.

Economists Dan Hanson and Ana Andrade expect a modest pickup in the first quarter on the back of government spending but say a recession can’t be ruled out.

“We’ve been surprised by the weakness as of late and it’s possible activity continues to disappoint,” they wrote ahead of the figures. “That could push the economy into a technical recession over the winter, giving the central bank a reason to rethink its gradual approach to cutting rates.”

The BOE set a gloomy tone last week as it cut interest rates for the third time since August. It forecast the economy shrank 0.1% in the fourth quarter, halved its 2025 projection to 0.7% and predicted inflation will be higher than previously thought, largely due to a resurgence in energy prices. Governor Andrew Bailey signaled a “gradual and careful” approach to further cuts, interpreted by money markets as just two or three more this year.

Advertisement 4

Article content

Growth is essential if Labour is to deliver on its election promises to fix public services and boost investment. Last month, Reeves pledged new wind turbines, roads, airports, railways and trade deals in her bid to revive the flagging economy but economists warn that such projects will take time to deliver. The chancellor faces a reckoning as the OBR assesses the state of the economy for her March 26 Spring Statement.

The fiscal watchdog has cut its growth projection, with an early forecast delivered last week leaving Reeves facing a small deficit, Bloomberg reported on Tuesday. The combination of the downgrade and bond market moves that have raised borrowing costs since October wiped out the slim £9.9 billion margin she left against her rule that day-to-day spending must be paid out of taxes.

Reeves now faces being forced to cut spending, having said she will not raise taxes for the time being after triggering a backlash from businesses following the budget.

Ten-year bond yields in the UK are around 4.5%, similar to those in the US. The gap in growth rates is stark, however. The American economy grew almost 3% in real terms last year, boosted by the willingness of consumers to spend. The BOE estimates just 0.7% for the UK, the same pace as the euro area, with no pickup until 2026.

“The one variable where the UK stands out, and we’ve been speaking about this, is the R minus G (rates minus growth),” Peder Beck-Friis, an economist at PIMCO, told the House of Lords Economic Affairs Committee last week during a hearing on the UK’s debt position. “It’s really only Italy that borrows at high interest rates compared to growth rates like in the UK.”

Article content