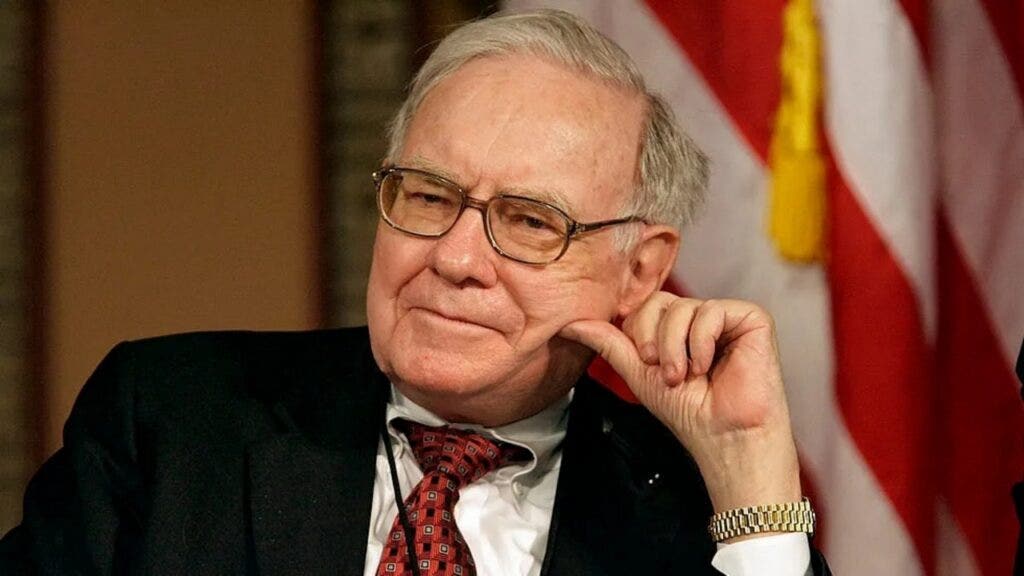

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway (NYSE:BRK)(NYSE:BRK), sent a subtle but pointed message to President Donald Trump in his latest annual letter to shareholders. While celebrating Berkshire’s success, including a record-setting $26.8 billion corporate tax payment in 2024, Buffett urged the government to “spend it wisely.”

Buffett said Berkshire Hathaway paid more in corporate taxes last year than any company in U.S. history, even surpassing the tech giants.

He emphasized that this contribution should be used responsibly, writing, “Thank you, Uncle Sam. Someday your nieces and nephews at Berkshire hope to send you even larger payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better. And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part.”

While Buffett has historically avoided direct political commentary in his shareholder letters, his remarks reflect the economic principles he has long supported, including responsible fiscal management and support for those in need. CFRA Research analyst Cathy Seifert told the Associated Press that Buffett’s statement was “a powerful message” delivered in a measured, non-confrontational tone.

Berkshire Hathaway‘s financial strength continues to grow, with cash reserves swelling to $334.2 billion. Theincrease comes after the company sold off significant portions of its Apple (NASDAQ:AAPL) and Bank of America (NYSE:BAC) holdings, reflecting a cautious investment approach. Buffett’s ability to hold cash and wait for the right investment opportunities has been a key part of his long-term success.

Despite sitting on a massive cash pile, Buffett reassured shareholders that Greg Abel, his chosen successor, is prepared to seize investment opportunities when the time is right. Berkshire made several strategic moves in 2024, including spending $3.9 billion to acquire the remaining stake in its utility business and $2.6 billion to complete ownership of the Pilot truck stop chain. Additionally, the company continued increasing its investment in five major Japanese conglomerates, a strategy that has proven lucrative.

Buffett acknowledged that 53% of Berkshire’s 189 subsidiaries reported lower earnings in 2024. However, the company still posted strong overall results, largely due to higher interest income on its short-term investments and increased profits from its insurance businesses. Berkshire reported $14.5 billion in operating profits for the fourth quarter, up significantly from $8.5 billion the previous year.