Japan’s industrial production grew at the fastest clip in nearly a year, as manufacturers sought to meet strong demand before the US implements new tariffs on autos and auto parts.

Article content

(Bloomberg) — Japan’s industrial production grew at the fastest clip in nearly a year, as manufacturers sought to meet strong demand before the US implements new tariffs on autos and auto parts.

Article content

Article content

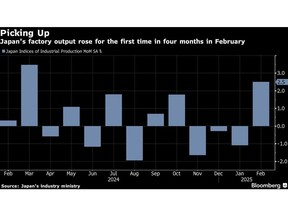

Factory output increased in February by 2.5% from January, the first advance in four months and marking the fastest gain since March last year, the Industry Ministry reported Monday. Economists had expected a 2.0% gain. Output rose 0.3% from a year ago, missing the consensus call of a 1.2% rise.

Advertisement 2

Article content

The ministry also reported that retail sales increased 0.5% in February from January, slightly better than the forecast, while they gained 1.4% versus the previous year.

Monday’s data are consistent with the Bank of Japan’s assessment that the economy has recovered moderately even though there are pockets of weakness. Authorities will monitor closely to see if the rebound in output can be sustained in the face of rising tariffs in the US. US President Donald Trump signed an order last week to impose a 25% tariff on foreign-made vehicles effective April 3, with some auto parts to be added in May.

Those duties are in addition to steel and aluminum tariffs introduced earlier this month and so-called reciprocal duties set to be announced early next month.

Article content

Advertisement 3

Article content

The figures highlight the mixed dynamics at work in Japan’s economy. The latest round of annual wage negotiations resulted in pledges by employers to offer the biggest wage increases in more than three decades, underscoring the competition to lure and retain staff in a tight labor market.

It was the second year of wage gains exceeding 5% for companies under the umbrella of Rengo, the Japanese Trade Union Confederation. Even so, the impact on spending has been muted due to sticky inflation. Private consumption was barely positive in the fourth quarter, and household spending has been spotty.

The BOJ’s Tankan survey due for release Tuesday is expected to highlight a different kind of disparity by showing that sentiment remains positive at large companies, while the gauge for small manufacturers is forecast to turn negative.

Advertisement 4

Article content

Amid the mixed trends, Japan’s auto sector is likely to come under particular pressure. The Trump administration’s latest tariffs could reduce the nation’s car production by 5.8%, while auto output in Canada and Mexico — which includes production from Japanese-owned factories — is expected to decline by 26.6% and 20.3% respectively, according to a forecast by Kenichi Kawasaki, a professor at the National Graduate Institute for Policy Studies.

The policies risk triggering retaliation steps from affected countries, further heightening global uncertainties and potentially undermining business sentiment.

With the global economy likely to face major disruptions, Japan may need to rely more on domestic demand to sustain growth.

(Updates with more details from both reports)

Article content