Atlas Invest, which has developed a digital platform allowing real estate developers to raise capital and loans from investors, has been voted by “Globes” readers as their favorite startup, as part of the Globes Most Promising Startup Rankings for 2025. In second place was Port.io, which has developed an internal developer portal and platform for software developers, and in third place was cybersecurity company Zero Networks, which helps companies cope hackers on enterprise networks, mainly in preventing ransomware attacks.

Some 6,000 “Globes” website readers participated in the poll over the past week, which included 30 growth stage startups. Other companies in the poll include: cloud backup company EON, which has become a sensation with investors; Asterix, the cybersecurity company for AI agents; AI-based programming engine Qodo; hospital payment system PayZen; and Agora, which provides a fintech solution for real estate investments, from the perspective of managing joint investments in assets.

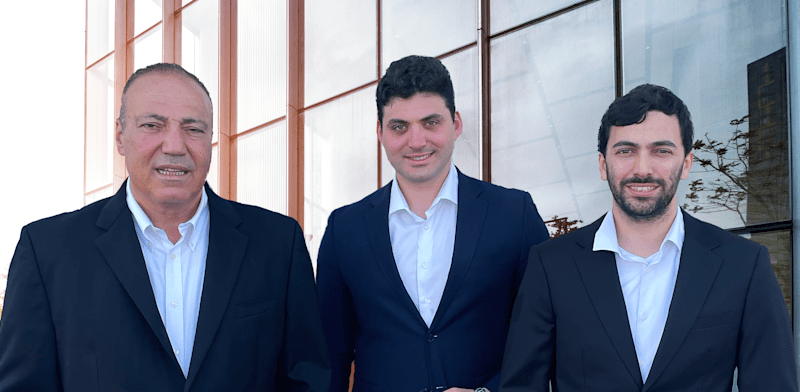

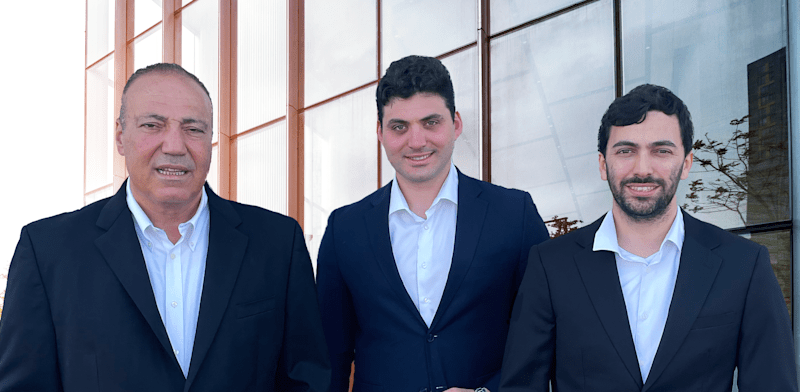

Atlas Invest’s story began almost by accident. Roni and Nir Peled, father and son, veteran developers in Israel’s real estate sector, began receiving unexpected inquiries from real estate developers in the US, seeking financing for projects. “At first, they didn’t understand why they were being approached,” says Tal Shahar, the CEO and third partner. “But slowly the picture became clearer – the banks are simply not interested in handling small, short-term loans, because the operating costs are too high for them.”

The need that these developers identified, along with the lack of response from banks, became an opportunity. Shahar, who comes from a technology and investment background, with a degree in computer science and entrepreneurship, experience in founding a previous startup and a partnership in the venture capital fund Deep Insight, where he is still active today, joined the Peleds.

At the end of 2022, they founded Atlas Invest to develop a platform that would connect institutional investors and real estate-backed loans – precisely where the traditional market has difficulty operating.

Today, just three years after it was founded, the company has offices in New York and Tel Aviv, 24 employees – most of them in Israel – and has so far brokered transactions worth more than $60 million through its platform, according to the entrepreneurs.

The company does not grant the loans itself, but rather provides institutional entities – including investment houses, funds and family offices – with a technological infrastructure that allows them to manage and distribute investments in real estate-backed loans in the US, while saving time and costs.

“We enable both parties – developers who need quick financing, and investors who are looking for a solid option – to meet in a smart way,” explains Shahar. A solid option, he adds, is an investment that is considered relatively safe – with low risk and stable returns. “Our technology analyzes all transactions in real time – asset valuation, risk identification, due diligence – in a much deeper and more efficient way than is currently common with private lenders.”

Old market, new platform

The short-term loan market for real estate developers in the US has been dominated for years by small private lenders, which often operate in a traditional, human-based manner, with lots of forms, manual processes and slow response times. “Anyone who starts a fund of $100 or $200 million quickly discovers that it is difficult for them to grow beyond that,” explains Shahar. “As such a fund grows, it can no longer handle a large number of small loans – it simply does not pay for itself operationally. That is why they abandon this field, and that is exactly where we come in.”

Key players currently active in the field include private lenders such as Hirshmark and S3 Capital, which focus on providing financing to real estate developers, often in amounts of tens of millions of dollars. Alongside these, there are also companies such as Sharestates, which offers asset-backed loans in a crowdfunding model, and Upright, which mainly appeals to qualified investors.

According to Atlas, most players in the market still rely on traditional operating models, with manual review processes and decentralized risk management. In addition, Atlas Invest’s great advantage, according to Shahar, lies in the fact that the system they developed allows them to manage a large number of small transactions efficiently and quickly – or in the terms of the technology world, “work at scale” – to perform many operations without losing control or increasing the cost of the process. He also stresses the focus on the volume of loans, with the company concentrating – unlike its rivals – on loans of up to $20 million.

The company has a B2B business model, which addresses only institutional entities. All loans provided through the platform are for real estate projects in the US. “The main reason for this is the availability of data,” explains Shahar. “In the US, there is high accessibility to data – both on assets and borrowers – and this allows us to perform an in-depth analysis of each transaction. In Europe and Israel, this information simply does not exist at the same resolution, so we are currently focused on the US market. In the future, we may expand, but not in the foreseeable future.”

Raised $13 million

Since its inception, the company has raised $13 million in three financing rounds, the most recent of which was when it raised $8.5 million in November 2024. Among the investors are the venture capital funds State of Mind Ventures and The Garage Fund (which led the last round), along with private investors such as Guy Gamzu, Boaz Schwartz, Jonathan Kolber and Roy Oron. Along with them are also the Anfield family investment office and holding company SaxeCap.

Shahar says that Atlas is currently on the verge of closing a significant deal with a large institutional body – a deal, which is valued at double the total amount of capital raised so far. “This deal will allow us to reach profitability in the short term,” he says.

Shahar stresses that Atlas’ approach differs from that of other startups on the market. “I don’t believe in running after funding without a real business plan.” He says, “We are moving forward responsibly – with actual revenue, active customers and growth based on a clear need.” In the context of recent market turmoil and Trump’s tariff policy, Shahar notes that uncertainty actually plays to their advantage. “In times of volatility, investors tend to seek stability,” he says, “and real estate-backed loans are seen as a safer and more attractive solution.”

The Tech-IL Conference will take place on Wednesday, April 23 at Startup Nation Central in Tel Aviv, when the “Globes” rankings of the 10 most promising startups in 2025 will be revealed. The list is being compiled for the 19th year by the votes of 80 venture capital tech investors active in Israel

Published by Globes, Israel business news – en.globes.co.il – on April 21, 2025.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2025.