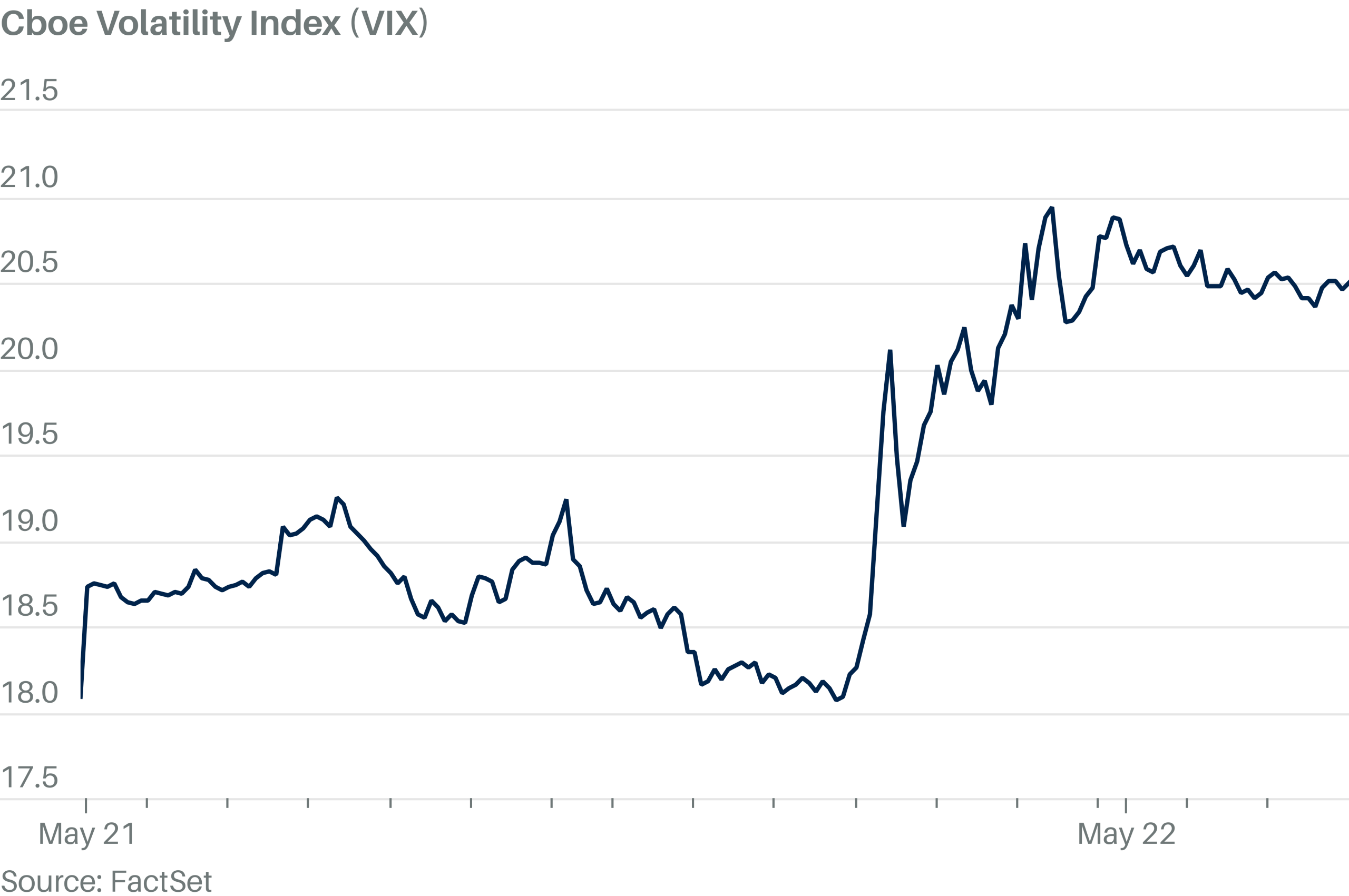

The most widely-followed gauge of market fear and uncertainty was sliding on Thursday, with steadier bond yields likely helping investors to feel a little calmer.#

The Cboe Volatility Index, which tracks S&P 500 options contracts and trades under the ticker VIX, fell 1.7% to 20.5. Any reading below 20 is typically seen as an indicator of relatively low volatility.

Yields spiked Wednesday after a weak auction of 20-year Treasury bonds, with the market on edge about President Donald Trump’s signature tax-and-spend bill, as well as the mounting U.S. deficit. But they were pretty much flat on Thursday, suggesting that the rout may not extend into another session.