While India’s Apple story is nothing short of glorious, it still hasn’t reached the high that China achieved in its initial similar timeframe, as explained by journalist Patrick McGee in his latest book.

McGee was Financial Times’ principal Apple reporter from 2019 to 2023, whose latest book ‘Apple In China’, published by Simon & Schuster, details how the company became one of the biggest in the world and how it had tied its fortunes with Beijing.

Apple’s move away from China was spurred by the Shanghai lockdown of 2022, which proved a major catalyst for change, said McGee. The journalist quoted a former executive who said: “China went from being a reliable supplier to a completely unreliable supplier.”

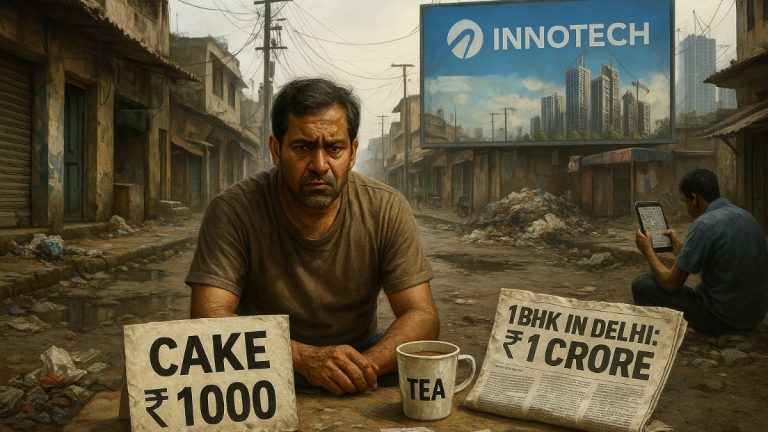

Meanwhile, Tim Cook had stated in a memo in October 2018 that India was poised for a “China-like trajectory”, but in the five years since, the push was still tepid. Cupertino was cautious and New Delhi was not entirely willing to be as welcoming as Beijing had been a decade earlier. The Indian government wanted foreign companies to source 30 per cent of the components locally.

“When the rules were relaxed in 2017, Apple suppliers began assembling some iPhones in India – with Taiwanese partner Wistron – a move that allowed Apple to avoid hefty tariffs. That made the iPhone more affordable to a rising middle class,” said McGee in his book. He pointed out that an online Apple Store only opened in 2020, and the first physical store three more years later – which was 15 years after the first store had opened in China.

India began with making entry-level iPhone SE models and moved on to produce flagship models. By 2023, there was no lag between distributions from China and from India, and made-in-India iPhones were available on the same day. By 2024, India was making the Pro models.

However, McGee said, India’s pace of growth was not comparable with China’s even a decade later. “From 2016 to 2023, iPhone production in India grew from zero to around 15 million units, accounting for 7 percent of global shipments. China, between 2006 and 2013, ramped production from zero to 153 million units. So, at best, India is taking on iPhone orders at one-tenth the rate China did a decade earlier,” said McGee in his book.

Even so, here is the bigger problem – the Apple operations in India are all FATP, which translates to final assembly, test and pack out. It is a labour-intensive process. Components are flown in from China, assembled by the Taiwanese companies Wistron and Foxconn.

McGee quoted a manufacturing design engineer who jokingly said made-in-India iPhones are “assembled in China, disassembled there, and then sent to China for reassembly”.

The journalist said that Apple intends India to become fully capable in every respect but that too is likely to take another 5-10 years. India operations are still in the early stages of building up capacity.

McGee quoted a former senior Apple engineer who said the pace of development hasn’t been quick. Having iPhone assembly in both China and India, dependent on the same supply chain, adds more complications than resilience, he said.

The lower labour costs of India gets offset by the added logistics of sending freight from China.