As Iran started firing missiles at a US air base in Qatar on Monday, oil traders responded with striking speed — not by buying, but by selling.

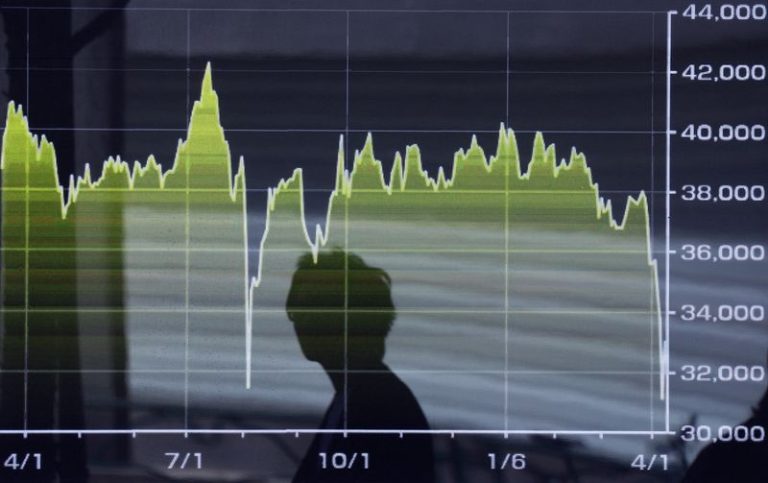

Within seven minutes of the first launch at about 5.30pm London time, Brent crude, the international benchmark, began to slide. It took only 20 minutes for the losses to accelerate to 3 per cent. By 7.30pm, the price had fallen 7.2 per cent to $71.48, the sharpest daily drop in nearly three years.

The speed of the sell-off in a market that typically surges at any sign of geopolitical strife caught many by surprise. Even as civilians took cover and television channels broadcast images of missiles in the night sky, traders had already correctly concluded that the attacks would reduce, rather than heighten, tensions between the US, Israel and Iran.

“It is all orchestrated, we know the base is empty. I knew from June 18 that the base was empty,” said Jorge Montepeque, an oil analyst at Onyx Capital Group, in a text message just after the attack began on Monday. “We have watched this movie before.”

Since the outbreak of hostilities between Israel and Iran, traders said they had been glued to social media and open source intelligence to interpret developments. “Everyone is in a similar boat, we are all tracking Twitter feeds, Osint accounts and everything you can to make sense of it,” said one executive at a major oil trading firm.

Oil traders, for example, homed in on satellite images of Al Udeid air base in Qatar, which hosts 10,000 US troops. They appeared to show that the US removed planes from Al Udeid days before its air raid on Iran’s nuclear facilities this past weekend, and Tehran’s response to the attack on Monday.

That intelligence helped traders to draw two conclusions: the missile launches were largely symbolic, and the Islamic republic, having demonstrated a response to US strikes on its nuclear facilities, was unlikely to further escalate by targeting the region’s most vulnerable asset — its oil infrastructure.

Oil and gas have continued to flow unimpeded from the region throughout the fighting, with Iran increasing its exports, according to energy consultancy Rystad, because it was unable to refine as much crude domestically.

That reflected another feature of the oil market: traders are often good at keeping barrels flowing during the kind of turmoil that sends other industries into flight.

The market’s reaction on Monday echoed its behaviour a week earlier, when crude prices initially rose as much as 5.5 per cent following Israeli air strikes on Iranian gas plants and fuel depots, before the gains evaporated when signs emerged that Tehran was seeking peace talks.

Both episodes illustrate how, since the fighting began, traders have narrowed their focus to one overriding question: is Iran more or less likely to threaten oil tankers moving through the Strait of Hormuz, the 33km wide chokepoint that connects Gulf producers with global markets?

“Everyone was focused on the Strait being shot at. As soon as it became clear that this was not going to happen, the risk premium came off,” said Amrita Sen, the founder of market intelligence firm Energy Aspects.

The oil trading executive noted that recent years have established a pattern: price jumps triggered by geopolitical drama often fade quickly. “This is not a situation like Ukraine and Russia where we have to reorient trade flows for a long time. This is a situation where the market is looking to sell any spike.”

Montepeque echoed the view, saying it was now standard practice to sell any significant development. “If you read the market right, you have the position in your favour, you are making money and you want to crystallise the gain and sell.”

Although the market anticipated the start of the war, with oil rising ahead of Israel’s initial attack, the broader backdrop has made traders reluctant to bet heavily on an increase in prices. The global oil market is well supplied, with the Opec+ oil cartel having significantly raised its output in recent months. US shale drillers are also keeping American output at record highs.

Helima Croft, a strategist at RBC, noted that the White House probably decided against tapping the US’s Strategic Petroleum Reserve even during the height of the energy market ructions in recent weeks because officials “were confident that they had other sources of spare barrels in the event there was a serious outage”.

Many analysts forecast that the world would be awash with crude by the end of the year, putting more pressure on prices. “Everyone still thinks this [oil] is going down to $50 or $60,” said Sen. “Once the risk is removed, people go back to looking at the fundamentals.”

A tentative ceasefire between Iran and Israel, brokered by President Donald Trump, triggered another sell-off on Tuesday, with Brent falling 6.1 per cent to just above $67 a barrel, below the level it was trading at before the war.

“The prevailing feeling is that Iran can’t do much more, and closing the Strait only hurts China, their only remaining ally of note,” said one oil trader. “There is nothing more the Israelis can do, the nuclear threat has subsided, any further aggression from them, wouldn’t be that well received.”

Analysts said the price fluctuations in the market had also been accentuated by positioning in options, derivatives that become more valuable when oil rises or falls towards a preset price.

With oil markets under pressure prior to the breakout of the conflict between Iran and Israel because of concerns over high supplies and tepid demand, some producers purchased “put” options, which pay out if crude falls.

Dealers manage these positions by purchasing futures, which are the main vehicles used in oil trading and which set the basis for the global oil price.

“As Brent fell, the probability rose that the dealers would have to pay out. So they had to sell more and more futures,” said Ilia Bouchouev, a former president of US commodity trader Koch Global Partners. This extra selling fuelled the sharp move lower on Monday, he said.

Al Munro, a broker at Marex, added: “There was a mad rush to the top and a mad rush down.”