Retail banking has undergone profound shifts over the past decade. Digital channels have undeniably transformed service delivery and broadened financial inclusion. Yet, despite the rise of mobile banking apps and AI-driven tools, the physical branch continues to play a vital role – especially in fostering trust, supporting the financially vulnerable, and anchoring community relationships.

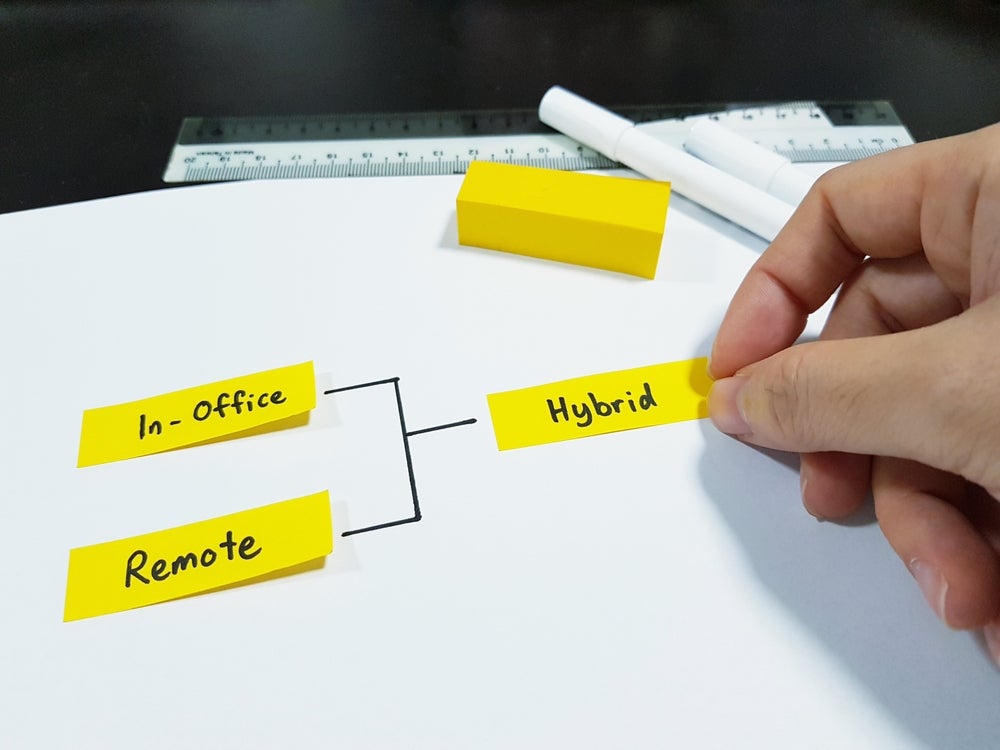

The hybrid branch-bank model is not simply a compromise between old and new. It is a strategic integration – blending the familiarity and assurance of in-person banking with the convenience and efficiency of digital services. This evolution is not driven by nostalgia but by customer demand across demographics and regions. Hybrid models reflect how real people live, bank, and engage.

Invest in Gold

Powered by Money.com – Yahoo may earn commission from the links above.

In emerging markets, branches remain the gateway to formal banking. They provide critical services where digital penetration remains low or inconsistent. And even in digitally mature countries, certain customer segments – the elderly, microentrepreneurs, and those with accessibility needs – prefer or rely on face-to-face interactions. Branches are not obsolete; they are being redefined.

A modern hybrid branch is no longer a transactional venue. Instead, it becomes a consultative hub – a space where complex financial decisions are discussed, where small businesses are nurtured, and where financial literacy is advanced. The future branch will be smaller, smarter, and more purposeful. It may have fewer counters, but it will have more tools – biometric authentication points, digital onboarding stations, and live remote advisory services.

In the hybrid model, branch staff are empowered to play broader roles. The traditional teller role is evolving into that of a universal banker – someone capable of guiding customers across physical and digital touchpoints. Upskilling, soft skills, and data literacy are becoming as important as operational knowledge. This human-centric approach adds warmth to technology.

Importantly, digital inclusion must not be an afterthought. In designing hybrid models, banks must ensure that technology is not a barrier. Interfaces must be intuitive. Language support must be thoughtful. Accessibility features must be embedded. And above all, empathy must underpin every digital journey. This is how we ensure inclusion is meaningful and sustainable.

Crisis periods have reinforced the value of having dual infrastructure. When digital platforms faced outages or cybersecurity threats, branches served as fallback anchors. Conversely, during lockdowns, mobile and online channels ensured continuity. Together, they build systemic resilience – something every modern bank needs as part of its risk strategy.

Another advantage of the hybrid approach is the capacity to drive personalised experiences. Customer insights gathered digitally can be deepened through human interaction. A digital trigger – say, a mortgage query – can lead to an in-branch consultation. This cross-channel intelligence, when handled responsibly, can uplift customer satisfaction and reduce churn.

The regulatory environment is also evolving. Hybrid models offer a proactive response – ensuring no customer is left behind, while also enabling banks to comply with evolving global mandates around financial access and consumer duty. Banks that embed digital within physical branches can serve communities more consistently and transparently.

Additionally, there is a growing opportunity to repurpose branches as centres of community engagement. From hosting SME workshops to facilitating digital literacy drives, branches can serve a broader social role. These initiatives not only enhance financial inclusion but also reinforce a bank’s standing as a trusted local partner.

Data analytics also plays a pivotal role. By leveraging in-branch behavioural insights and digital footprints, banks can personalise services, improve compliance, and reduce operating costs. But this must be done with care. Customers expect transparency – they want to know how their data is used and why. When done ethically, data can be a force for empowerment rather than exclusion.

This shift to hybridisation is not merely a tactical adjustment but a reflection of long-term structural change in customer expectations. Customers today want contextual banking – where the service, advice, or access is timely, relevant, and seamless across platforms. A hybrid branch delivers that continuity.

One important factor often overlooked is emotional intelligence in banking. Human interactions at branches still serve an irreplaceable role in resolving distress, clarifying complexity, or simply reassuring clients during uncertain economic times. While algorithms can recommend, only people can empathise.

From a regulatory perspective, hybrid branches align with growing expectations around inclusive access and responsible service models. As banks transition further into digital ecosystems, supervisory bodies are placing greater emphasis on fairness, reach, and customer understanding. Maintaining localised, digitally supported branches is one of the most effective ways to ensure these priorities are met in practice.

Globally, we observe that national strategies around financial wellbeing – such as the UK’s Consumer Duty or India’s Jan Dhan mission – align well with hybrid frameworks. Both emphasise simplicity, reach, and financial literacy. A branch with integrated digital advisory services can execute this vision at scale.

Hybrid models are also better suited to engaging younger customers, who may begin their journey digitally but require guidance on milestone decisions – buying a home, saving for education, or starting a small enterprise. These are moments where in-person conversations add trust to technology.

Cost efficiency is often cited as a barrier to retaining physical branches. However, data shows that branches reconfigured for multi-functionality, co-location with community services, and intelligent workforce deployment can achieve profitable impact. It’s not about square footage; it’s about strategic utility.

Leadership teams across global retail banks are increasingly looking at hybrid not as a transitional model but as a permanent backbone. It enables a distributed presence, resilience in operations, and a human-digital blend that reflects modern service economies. Banks that act now will shape the next decade of responsible banking.

To be clear, this is not a nostalgic defence of the branch. It is a forward-looking argument grounded in customer data, regulatory trends, and operational resilience. Digital-only may scale, but hybrid delivers sustainability – with impact rooted in real people, real lives, and real outcomes.

In summary, the hybrid branch-bank model is a dynamic, inclusive, and resilient response to the evolving landscape of financial services. It retains the best of traditional banking – personal trust, familiarity, and presence – while layering on the tools of tomorrow. As financial leaders, the onus is on us to ensure that our strategies reflect not just digital ambition but human purpose.

Dr. Gulzar Singh is Founder & CEO of Phoenix Thoughtworks

“Hybrid branch-bank models & digital inclusion in retail banking” was originally created and published by Retail Banker International, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.