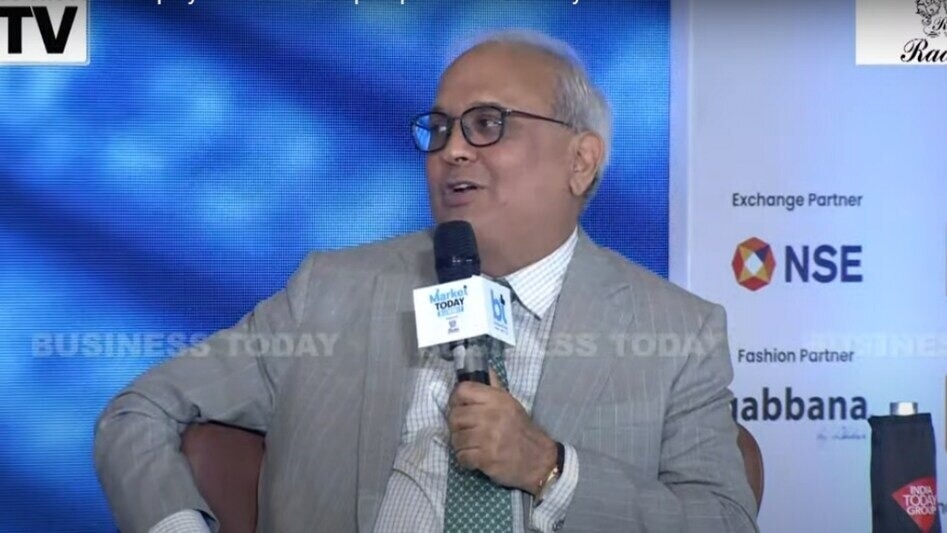

Helios Capital founder Samir Arora has reacted to MTNL’s RS 8,584.9 crore loan default by pointing to it as a real-world example of why long-term holding in individual stocks isn’t always a winning strategy. “The first stock I bought in my fund in December 1993. Thank God that A) I do not hold stocks forever & B) I do not have concentrated portfolio ever,” he wrote on X.

Arora’s post came in response to a report that listed MTNL’s outstanding loans across seven public sector banks. The biggest exposure was with Union Bank of India (Rs 3,733.2 crore), followed by Indian Overseas Bank (Rs 2,434.1 crore), Bank of India (Rs 1,121.1 crore), Punjab National Bank (Rs 474.7 crore), State Bank of India (Rs 363.4 crore), UCO Bank (Rs 273.6 crore), and Punjab & Sind Bank (Rs 184.8 crore).

MTNL’s default is among the largest in recent times by a government-owned firm, sparking fresh debate about the sustainability of loss-making PSUs and their impact on public banking. Once a key telecom operator in Delhi and Mumbai, MTNL has faced a decade-long financial decline due to falling subscriber numbers, operational delays, and rising private competition. Several revival efforts, including capital infusions and a planned merger with BSNL, have failed to turn the company around.

Arora used the MTNL episode to reinforce a larger investing principle he has frequently argued: that long-term equity holding only works when applied selectively. In a post last month, he wrote, “It is easy to disprove the argument that secret of success in equity investing is holding stocks for the long term. Secret is to find stocks that do well in the long term and hold them — and that is very difficult to do, for only less than 5% of stocks are worth holding for real long term periods.”

He added, “Every stock is collectively held by all shareholders for the long term (in fact forever). Whether A holds it for long term or B holds it for long term or shareholders A & B hold it collectively for long term should not matter to the returns given by the stock but we know that a very vast majority disappear even though one or a combination of shareholders (or collectively the market) held them for the long term.”

In another post, Arora gave a personal example to show the downside of long-term holding. “I know of many of my friends/relatives who bought physical shares in late 1980s/early 1990s, held them for 35 yrs and today those shares are worth zero or not worth chasing to find out their exact value. That is the big problem of equity.”

His view is in line with a shift among investment experts questioning the once-universal advice of “buy and hold.” In April this year, Akshat Shrivastava of Wisdom Hatch posted, “Gone are the days: where you could pick a good business. Invest. And, forget about it.” He added that even large-cap names like Amazon saw deep corrections, and that “Stocks these days: have like a 3–5 year cycle max… Having 20-year visions on stocks is futile now.”

Shrivastava outlined a four-part strategy for navigating today’s markets: “Buy a good asset cheap (good entry), ride the momentum, exit when it goes high (good exit), and rotate