Concord has successfully closed its latest asset-backed securities transaction to “fuel continued growth” at the independent music company.

According to a statement released on Tuesday (July 22), Concord is issuing $1.765 billion in bonds via a series of new five-year, seven-year, and ten-year senior notes.

The bonds are backed by Concord’s catalog of over 1.3 million music copyrights. Concord’s portfolio of music rights features songs and recordings of artists such as The Beatles, Beyonce, Bruno Mars, Carrie Underwood, Creedence Clearwater Revival, Daddy Yankee, Ed Sheeran, Genesis, Imagine Dragons, John Fogerty, Kiss, Michael Jackson, Otis Redding, Phil Collins, Pink Floyd, R.E.M., Rihanna, Rodgers & Hammerstein, Taylor Swift, and The Rolling Stones.

The latest bond issuance represents Concord’s fourth securitization offering and is claimed to be “the largest and longest tenured asset-backed term securitization of music rights to date”.

The company said on Tuesday (July 22) that the transaction was more than three times oversubscribed, reflecting what it called “robust investor demand underpinning Concord’s ABS strategy”.

As reported by MBW earlier this month, the music rights portfolio backing the bonds is valued at more than $5.1 billion. The notes were rated A+ and A2, respectively, by ratings agencies, KBRA and Moody’s.

Apollo, through its Capital Solutions business and affiliates ATLAS SP Partners and Redding Ridge Asset Management, structured the ABS transaction and formed an investor syndicate led by Apollo-managed funds and affiliates.

Proceeds from the issuance will be used to repay the company’s $1.65 billion 2022-1 note series and refinance and extend its $100 million variable funding note.

Apollo Global Securities, LLC and ATLAS SP Securities acted as joint bookrunners for the transaction. Redding Ridge Asset Management served as structuring agent, with the Bank of New York Mellon acting as trustee.

Virtu Global Advisors, LLC provided valuation services, while DLA Piper provided legal counsel for Concord and Milbank LLP for Apollo affiliates.

“ABS transactions like the one we just closed will remain a vital part of our growth strategy, allowing us to continue to lower our cost of capital while expanding our global capabilities in support of the artists and songwriters we serve.”

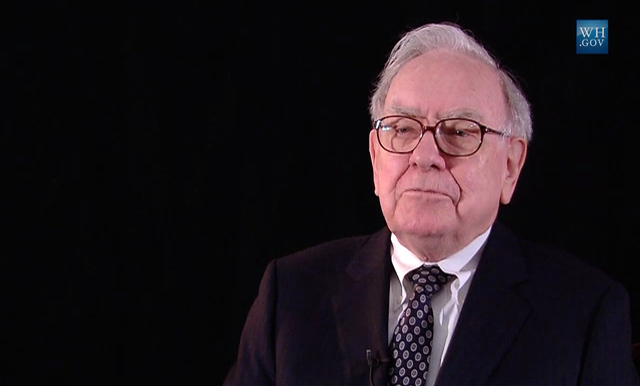

Bob Valentine, Concord

Bob Valentine, CEO of Concord, said: “As Concord continues to grow both our catalog and frontline roster, ensuring long-term access to institutional capital and continuing to build upon our strong financial foundation are crucial.

“ABS transactions like the one we just closed will remain a vital part of our growth strategy, allowing us to continue to lower our cost of capital while expanding our global capabilities in support of the artists and songwriters we serve.

“I am incredibly grateful to the Apollo team, who continue to provide customized solutions so that Concord can live out its mission to elevate the voices of artists around the world.”

“We continue to be impressed by the quality and breadth of the actively managed catalog that Concord has built and look forward to supporting its journey for years to come.”

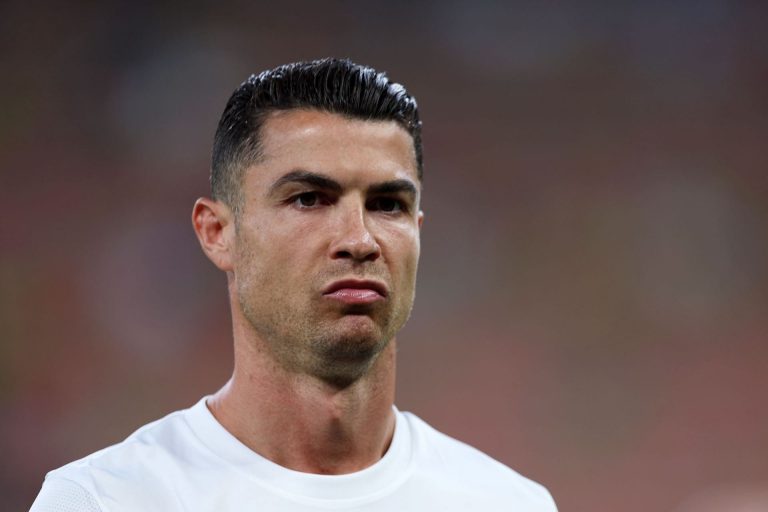

Michael Paniwozik, Apollo

Apollo Partner Michael Paniwozik, said: “We are pleased to structure and lead this landmark ABS transaction for Concord, which represents a continuation of our long-term financing partnership and demonstrates Concord’s innovative approach to music securitization through the issuance of the industry’s first 10-year tranche.

“We continue to be impressed by the quality and breadth of the actively managed catalog that Concord has built and look forward to supporting its journey for years to come.”

“It has been immensely rewarding to support Concord’s continued evolution leveraging the ABS structure that we established in 2022.”

Paul Sipio, Apollo

Apollo Managing Director Paul Sipio, said: “It has been immensely rewarding to support Concord’s continued evolution leveraging the ABS structure that we established in 2022.

“Since that time, Bob and team have made tremendous progress advancing the company’s growth strategy through several additive acquisitions.

“We believe the four transactions that we’ve executed with Concord to date reflect the differentiated nature of Apollo’s integrated platform, bringing together combined capabilities of Apollo, ATLAS SP, and Redding Ridge to provide tailored structured solutions.”

Concord’s latest ABS transaction follows an $850-million issuance in October last year (five-year notes maturing in October 2029), part of which was used to acquire a $217 million catalog from Latin music superstar Daddy Yankee.

While asset-backed securities (ABS) have long been a part of the financial world, they’re a relatively new arrival in the music rights space, rapidly gaining popularity over the past several years.

Blackstone-owned Hipgnosis closed a $1.47-billion ABS transaction last fall, which the company said would be used to “repay existing debt in full and support future acquisitions.”

Other recent ABS deals in the music rights world include a $500 million issuance to investment giant KKR by HarbourView last month; a $360 million issuance by Influence Media Partners this past January; a $266.5 million issuance by Kobalt in March of last year; and an $80 million issuance by indie music rights-focused Duetti last October.Music Business Worldwide