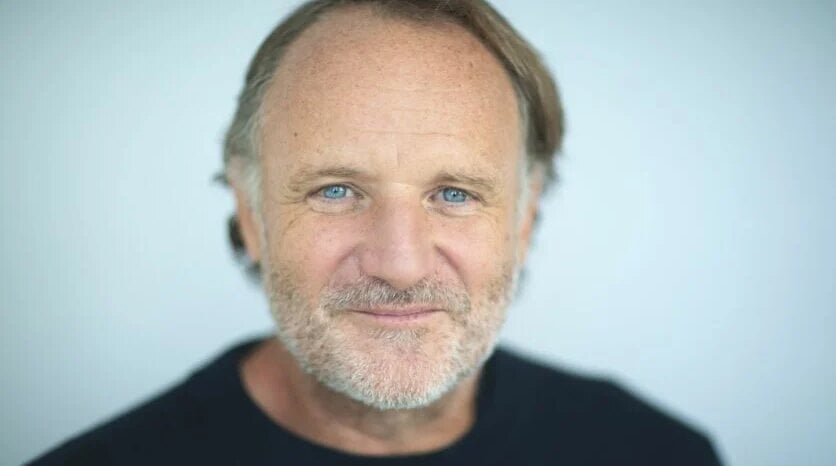

Denis Ladegaillerie, the founder and CEO of Believe, is once again leading a private company.

As previously reported, Ladegaillerie has teamed up with the EQT X fund plus funds advised by TCV to form a private consortium.

As of last month, that consortium owned 96.65% of Believe, with the remaining ~4% of the company still trading on the Paris Euronext.

Today (July 22), Believe has ceased trading on that stock market, with Ladegaillerie’s consortium in the final throes of a ‘squeeze-out’ to regain full control of the business.

Under French financial law, a company’s owners can force public shareholders to sell their shares in a business – aka: a ‘squeeze-out’ – so long as only a fraction of said business remains trading on a public exchange.

Believe’s remaining public shareholders had until yesterday (July 21) to accept the Ladegaillerie consortium’s buyout offer of EUR €17.20 per share.

Some of those shareholders said yes: according to Believe, at yesterday’s close, the consortium ownership had increased to 98.67% of the company’s share capital and 97.40% of the voting rights.

However, some shareholders – those holding just 1.33% of Believe’s equity – didn’t accept Ladegaillerie’s offer by the deadline.

Alas, thanks to the ‘squeeze-out’ element, this was ultimately an offer… they could not refuse.

The 1.33% of Believe shareholders who didn’t accept the consortium’s offer by yesterday are now expected to see their shares transferred to Ladegaillerie and co. anyway via a ‘compulsory withdrawal’ for the €17.20 per share price.

Believe has confirmed that the consortium will file a request with the AMF (France’s equivalent of the USA’s SEC) in the coming days to complete this ‘squeeze-out’ process.

Public trading of Believe’s shares has been suspended today (July 22) ahead of the finalization of the ‘squeeze-out’.

Believe – now effectively private – also says it will cease public financial communications.

As a result, Believe has confirmed that its half-year results for 2025 will not be made public.

Last year, Ladegaillerie’s consortium gained majority control of Believe, securing 94.99% of the company’s share capital through a €15-per-share takeover bid. That transaction valued Believe at about €1.43 billion ($1.63 billion).

EQT previously said that, via its stake in the Ladegaillerie consortium, it expects to be “30-35% invested” in Believe. This implies that EQT X now owns around a third of the equity in Believe.

EQT, a global investment organization with €269 billion ($305.5 billion) in total assets under management, has increased its exposure to music-related assets. It has also invested in Epidemic Sound and talent agency UTA.

Music Business Worldwide