We recently published These 10 Stocks Fell Hard. Are You Holding Any? Schlumberger Limited (NYSE:SLB) is one of this week’s top performers.

Schlumberger saw its share prices decrease by 10.69 percent week-on-week from $37.31 on July 11 to $33.32 last Friday, as investor sentiment was dampened by a disappointing earnings performance in the second quarter of the year.

In its earnings release, Schlumberger Limited (NYSE:SLB) said attributable net income, excluding charges and credits, fell by 17 percent to $1.016 billion from $1.224 billion in the same period last year.

Revenues dropped by 6 percent to $8.546 billion from $9.139 billion year-on-year.

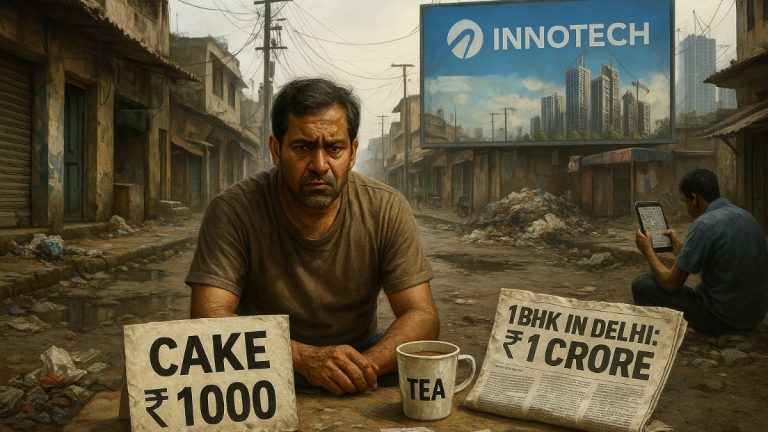

An aerial view of a well site, depicting the scale of oil and gas operations.

Schlumberger Limited (NYSE:SLB) regarded its performance as “solid,” saying that it leveraged its diversified portfolio and broad market exposure to deliver steady revenues despite the market navigating several dynamics and macroeconomic uncertainties.

“Despite this, commodity prices have remained range-bound. Meanwhile, customers have selectively adjusted activity, prioritizing key projects and planning cautiously, particularly in offshore deepwater markets,” it said.

While we acknowledge the potential of SLB as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an extremely cheap AI stock that is also a major beneficiary of Trump tariffs and onshoring, see our free report on the best short-term AI stock.