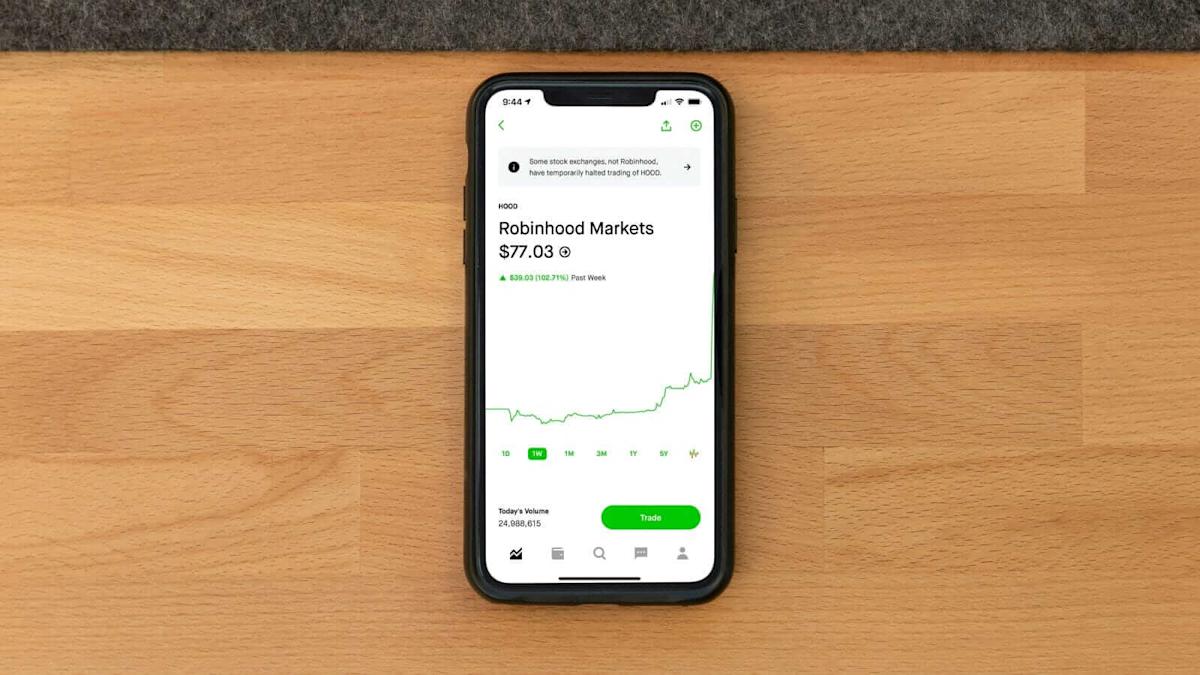

Robinhood (HOOD) has been rallying this year, gaining close to 185% in the year to date, with a majority of its gains coming in the last three months, with shares up 165% in that period. The stock has set a series of all-time highs, topping out at $113 on July 18 before cooling off to trade near $104 on July 21.

Investors should note that this is the first time the stock has broken through the $100 threshold.

Robinhood posted its first quarter results on April 30, reporting a profit of $0.37 per adjusted share against analysts’ $0.33 per share estimate. Revenue during the quarter came to $927 million, beating Wall Street’s $915.7 million estimates while registering 50% growth from the same quarter last year.

Of this total, transaction-based revenue accounted for $583 million, up 77%. Net interest revenue grew 14% year-over-year to $290 million.

Robinhood reported adjusted EBITDA of $470 million, falling short of analysts’ $490.5 million estimate, while the margin came to 51%, up from 40% in the year-ago period.

Robinhood’s funded customers saw a spike of 1.9 million on a year-over-year basis to 25.8 million. Average revenue per user (ARPU) rallied 39% to $145. Gold subscribers nearly doubled from 1.7 million to 3.2 million.

Overall, the company ended the quarter with a cash balance of $4.4 billion.

Despite being excluded again and again from inclusion in the illustrious S&P 500 Index ($SPX), shares of Robinhood have been hitting new all-time highs.

The surge comes as the company unveils an ambitious expansion into Europe, including private investments into popular companies like OpenAI and SpaceX. This provides a new frontier for retail investors looking to get into unlisted companies.

“This presentation and these products are dual-purpose. The first purpose is obviously to deliver great products to users, but I think the second purpose is to just demonstrate very concretely how great it could be if crypto technology and traditional financial services could fully merge,” said CEO Vlad Tenev to CNBC in an interview.

Robinhood’s stock rides on positive investor sentiments with a “Moderate Buy” rating from Wall Street alongside a mean price target of $89.89, signalling downside potential of 14% from current market levels. The stock has been reviewed by 21 analysts while receiving 12 “Strong Buy” ratings, two “Moderate Buy” ratings, six “Hold” ratings, and one “Strong Sell” rating.