Knight-Swift Transportation reported only modest sequential improvements to trends during the second quarter. The company relied on cost cutting and operational efficiencies to squeak past analysts’ expectations.

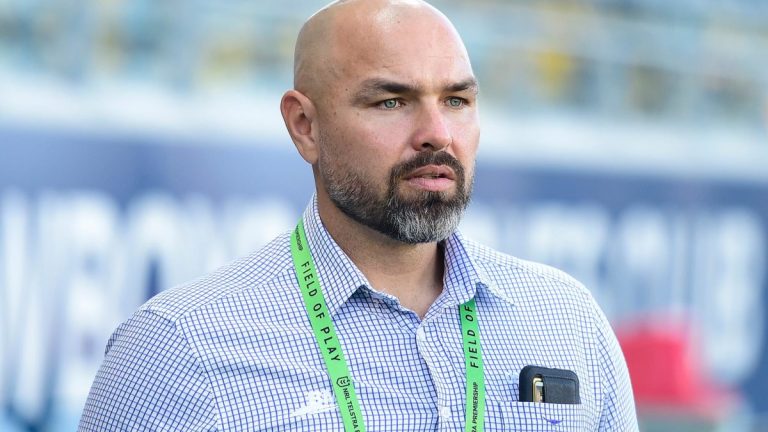

“In a quarter of unusual crosscurrents, we leveraged our cost initiatives and the agility of our over-the-road model to overcome a truckload market that lacked the normal seasonal build and which brought mix changes that put more pressure on revenue per mile than anticipated,” CEO Adam Miller said in a news release after the market closed on Wednesday.

Knight-Swift (NYSE: KNX) reported adjusted earnings per share of 35 cents for the second quarter, which was in line with management’s prior outlook of 30 to 38 cents. The result was 2 cents ahead of analysts’ expectations and 11 cents higher year over year.

Truckload revenue fell 3% y/y as average tractors in service declined 7%, which was partially offset by a 4% increase in revenue per tractor. The “unseasonably soft” quarter produced a 94.6% adjusted operating ratio (inverse of operating margin), 260 basis points better y/y but just 100 bps improved from the first quarter.

The company’s less-than-truckload business saw a 28% y/y increase in revenue, which was largely driven by a recent acquisition. Revenue per hundredweight, or yield, was up 10% y/y excluding fuel surcharges. A 14% increase in length of haul and a 3% decline in weight per shipment were tailwinds to the yield metric.

The LTL unit reported a 93.1% adjusted OR, which was 720 bps worse y/y. Acquisition integration costs and startup expenses at new terminals were the headwinds.

Knight-Swift’s intermodal segment was unprofitable for a ninth consecutive quarter, reporting a 104.1% OR.

The adjusted EPS result excluded expenses tied to past acquisitions as well as asset impairments and severance costs. The number included gains on equipment sales of $11.7 million, a $5.7 million y/y increase, or a 3-cent tailwind. A lower tax rate in the quarter was nearly a 2-cent y/y tailwind.

The company guided adjusted EPS of 36 to 42 cents for the third quarter, which bracketed Yahoo Finance’s consensus estimate of 38 cents at the time of the print. Knight-Swift didn’t provide a fourth-quarter guide due to “significant uncertainty created by the current fluid trade policy situation and its implications for inflation, consumer demand, and demand from our customers,” a press release said.

Knight-Swift will host a conference call at 5:30 p.m. EDT on Wednesday to discuss second-quarter results.