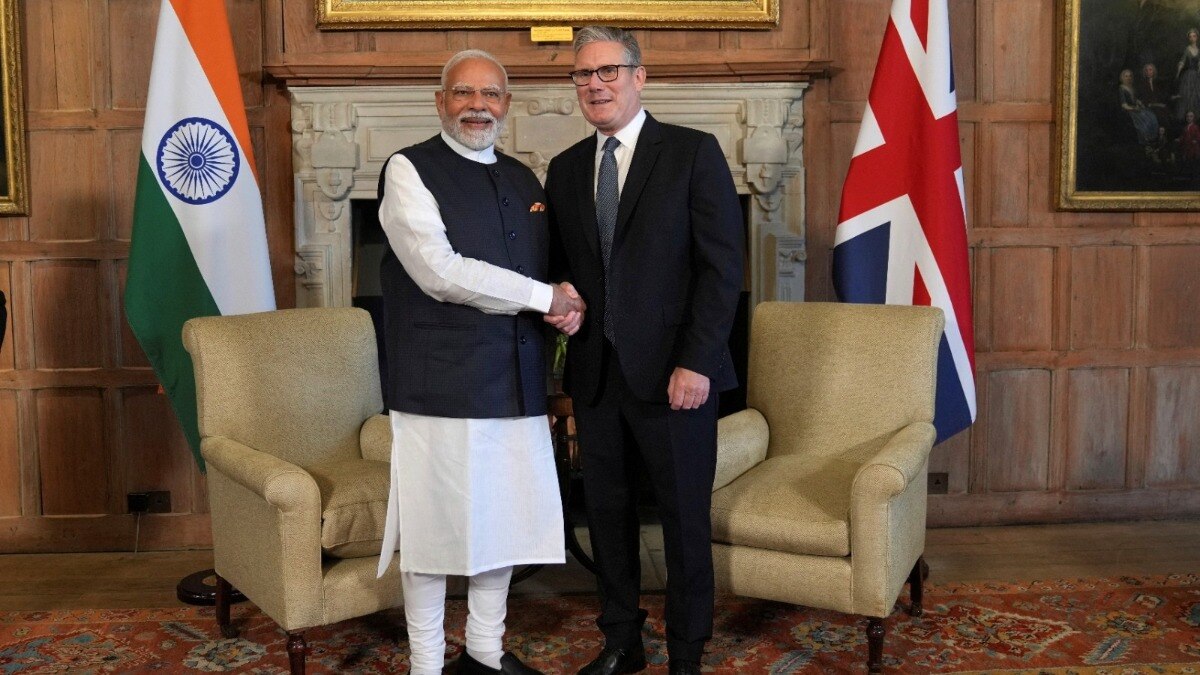

The recently signed Double Contribution Convention (DCC) between India and the United Kingdom, part of the Comprehensive Economic and Trade Agreement (CETA), is set to significantly benefit Indian expatriates working temporarily in the UK. Under this agreement, Indian nationals on short-term visas will be exempt from contributing to the UK’s National Insurance Contributions (NIC) for up to three years, enabling savings of Rs 30-40 lakh per individual. This exemption offers substantial financial relief to the expatriates involved.

Around 75,000 Indian workers on short-term visas in the UK and 900 British employers are set to benefit from the Double Contribution Convention (DCC), which took effect alongside the signing of the UK-India Comprehensive Economic and Trade Agreement (CETA) on Thursday. The DCC exempts Indian workers and their employers from paying the UK’s National Insurance Contribution (NIC) for up to three years. A similar exemption will apply to British citizens working in India.

The DCC aims to prevent dual social security contributions, enhancing the financial security of around 75,000 Indian expats and 900 Indian employers. Ministry officials, as reported by the Hindu Businessline, highlighted that the average IT professional, earning approximately £50,000 per month, will contribute 23% of their salary to India’s Employees’ Provident Fund Organisation (EPFO) instead of the UK system, ensuring substantial savings. This financial redirection is expected to provide a more secure economic future for the workers.

“This official pro-worker cost benefit assessment was factored into by the Labour and Employment Ministry at the time of preparing the Union Cabinet note ahead of the negotiations with the UK for getting rid of double social security contributions by expats temporarily employed in Britain,” a senior official explained. The agreement reflects the broader ethos of the International Labour Organisation, which advocates for equal treatment of all workers, including migrants. Such principles are foundational to fair labor practices globally.

The UK anticipates economic gains from the deal, with projections suggesting an annual addition of £4.8 billion to its GDP and a £2.2 billion boost to UK wages. “When agreeing to negotiate a DCC with India, the government took account of the benefits of the wider trade deal,” the UK administration noted, indicating the mutual benefits expected from this bilateral arrangement. These projections highlight the potential for significant economic growth and improved labor market conditions.

Social security arrangements

For India, the agreement aligns with existing social security arrangements with 22 other countries, and the Modi government is hopeful of negotiating similar terms with the United States. The deal is expected to streamline social security contributions, making it easier for businesses and employees to manage their finances. This alignment with international standards is crucial for fostering global economic partnerships.

The financial implications are substantial. With contributions redirected to the EPFO, Indian workers can expect an improved financial outcome upon completing their assignments in the UK. Furthermore, the exemption from UK NICs could translate into significant cost savings for both employees and their employers. This financial strategy supports long-term economic stability for the expatriates.

The UK hosts 1,197 Indian-owned companies—a 23% rise from 971 in 2024—employing 126,720 people with a combined revenue of £72.14 billion, according to Grant Thornton UK.

India already has social security agreements with 22 countries, and the Labour Ministry has urged prioritising similar schemes in future FTAs, especially with countries like the US that have a large Indian expat base.

The broader context of CETA and DCC reflects a strategic move to not only protect expatriate workers but also to bolster economic ties between India and the UK. This agreement is seen as a proactive measure to enhance competitiveness and economic collaboration on both sides.