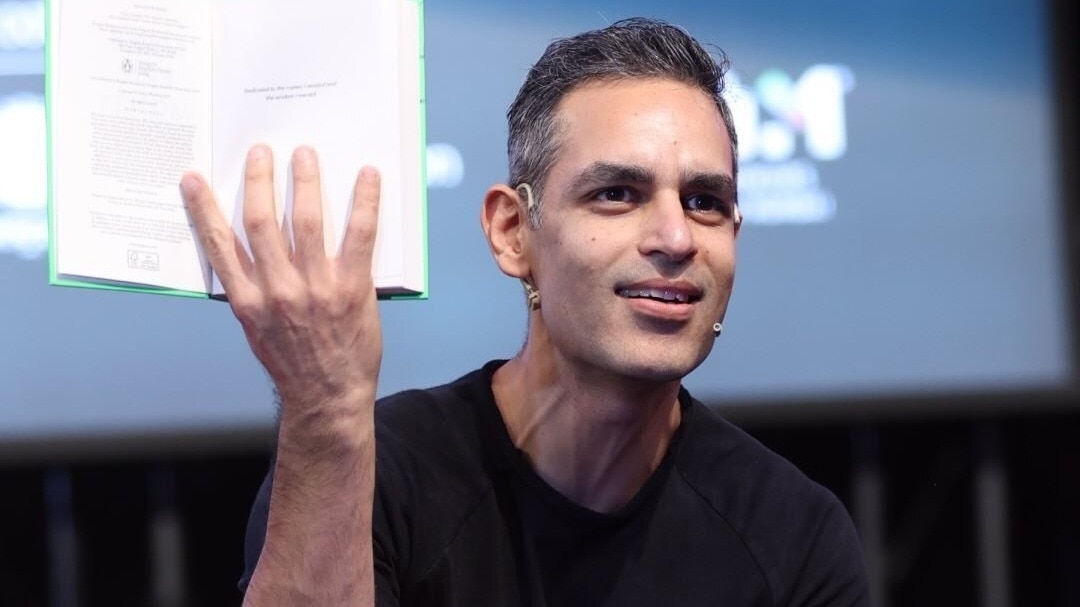

Zerodha may have the trust of India’s serious investors—but it’s losing the attention of its future ones, says entrepreneur Ankur Warikoo, reacting to a candid post by Zerodha founder Nithin Kamath about the firm’s declining demat market share.

BODY: “Zerodha is accurate. But it’s not fun,” Warikoo wrote on Thursday, responding to Kamath’s public query on whether old-school marketing still works in a shifting financial landscape. “It’s where the serious money goes to grow. But it’s not where the cool kids start their journey.”

Kamath had acknowledged the shift himself, stating, “Our AUM share is growing… but our demat share is shrinking.” He added that younger users—especially from tier 2 and 3 cities—are increasingly choosing other platforms. Kamath’s core question: Can legacy strategies still drive growth?

Warikoo, who has a large following among India’s young investors, didn’t hold back. He described today’s first-time retail investors as young, impatient, and socially driven. “To this investor, Zerodha’s features are vanity. The decision comes down to: ‘Where do my friends go?’”

He also called out Zerodha’s brand language and product names—Kite, Coin, Varsity—as sounding technical and uninspiring to Gen Z. “To most people, it sounds like ‘zero-something.’ It doesn’t feel aspirational,” he noted, contrasting it with brands like Groww and Upstox.

Among his suggestions: unify Zerodha’s apps, introduce social investing tools, create relatable content in Hinglish, and show up where young investors actually are—gaming streams, college fests, meme pages. “You don’t have to run ads. But you have to show up in their world,” he wrote.

Zerodha’s problem, Warikoo concluded, isn’t performance—it’s presence. “Zerodha has earned trust. Now it needs to earn attention. Not through noise. But through relevance and culture.”