By Lucia Mutikani

WASHINGTON (Reuters) -U.S. business activity slowed to a 16-month low in April while prices charged for goods and services soared amid uncertainty caused by tariffs, reinforcing financial market fears of stagflation that could put the Federal Reserve in a tough spot.

The survey from S&P Global on Wednesday also showed President Donald Trump’s ever-shifting trade policy, which has boosted the United States’ average effective tariff rate to levels not seen in more than a century, and an immigration crackdown were hurting exports, including tourism.

Businesses were also reluctant to hire, which S&P Global said was down to “concerns over the economic outlook and demand environments both at home and in export markets, with rising cost concerns and labor availability.” Confidence about business conditions over the next 12 months also deteriorated.

“S&P’s survey implies the economy is settling down to a sluggish pace of growth, rather than hurtling towards recession,” said Samuel Tombs, chief U.S. economist at

Pantheon Macroeconomics.

S&P Global’s flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, dropped to 51.2 this month. That was the lowest level since December 2023 and followed a reading of 53.5 in March. A reading above 50 indicates expansion in the private sector.

The survey was conducted between April 9-22, well after Trump’s “Liberation Day” tariffs announcement and subsequent 90-day delay of reciprocal duties on more than 50 trade partners. Trump, however, raised tariffs on Chinese imports to 145%.

Beijing retaliated with duties of its own, unleashing a trade war between the two economic giants. A 10% universal tariff on nearly all trading partners remains in effect as do 25% duties on automobiles, steel and aluminum.

The tariffs, which Trump sees as a tool to raise revenue to offset his promised tax cuts and to revive a long-declining U.S. industrial base, have stoked fears of high inflation and stagnation in economic growth.

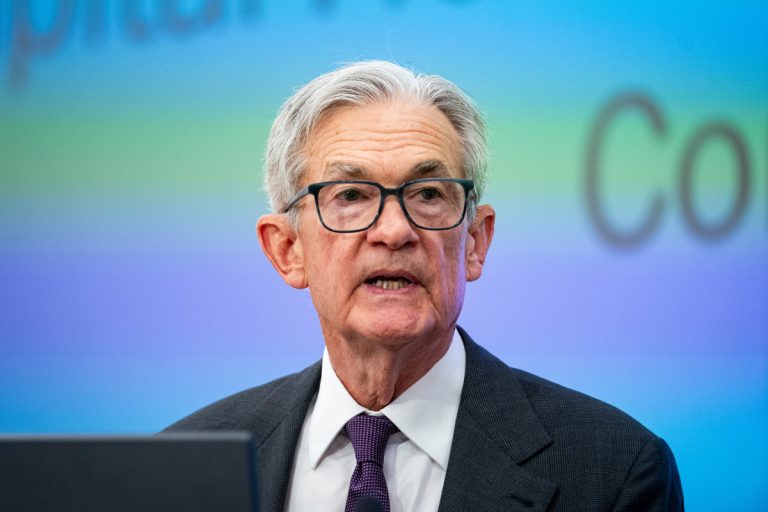

That together with Trump’s attacks on Federal Reserve Chair Jerome Powell, which raised concerns over the U.S. central bank’s independence, prompted investors to dump U.S. assets.

Trump on Tuesday backed off from threats to fire Powell, while a White House source said on Wednesday the administration would look at lowering tariffs on imported Chinese goods pending talks with Beijing, sparking a relief rally on Wall Street.

The pullback in the Composite PMI suggested that economic activity was tepid at the start of the second quarter. Economists believe economic growth braked sharply in the first quarter, with gross domestic product estimates converging below a 0.5% annualized rate.

The government is scheduled to publish its advance GDP estimate for the January-March quarter next Wednesday, which will coincide with Trump’s 100 days in office. The economy grew at a 2.4% pace in the fourth quarter.

“Tariffs on, tariffs off. China trade war, but expect de-escalation soon,” said Scott Helfstein, head of investment strategy at Global X. “Everyone is feeling a little whiplash and that seems to be evident in some of these business surveys.”

Stocks on Wall Street surged to one-week highs. The dollar rebounded against a basket of major currencies. U.S. Treasury yields declined.

SLUGGISH GROWTH

The S&P Global survey’s business confidence measure was the lowest since July 2022. Its gauge of new orders received by businesses slipped to 52.5 from 53.3 in March, hampered “by a fall in exports of services, which include tourism-related activities as well as cross-border activities by service providers on a scale not seen since January 2023.”

Manufacturing orders ticked up, but that was offset by declining exports, also attributed to trade policy.

Prices charged by businesses for goods and services increased to a 13-month high of 55.2 from 53.5 in March, driven mostly by manufacturers.

“These higher prices will inevitably feed through to higher consumer inflation, potentially limiting the scope for the Fed to reduce interest rates at a time when a slowing economy looks in need of a boost,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

Powell last week suggested the Fed was in no rush to move on interest rates, but cautioned Trump’s tariff policies risked pushing inflation and employment further from the central bank’s goals. The Fed’s benchmark overnight interest rate is currently in the 4.25%-4.50% range.

A gauge of employment slipped to 50.8 from 51.5 in March.

The survey’s flash manufacturing PMI edged up to 50.7 from 50.2 in March. Economists polled by Reuters had forecast the manufacturing PMI declining to 49.1.

Its flash services PMI dropped to 51.4 from 54.4 last month. Economists had forecast the services PMI falling to 52.5.

A separate report from the Commerce Department’s Census Bureau showed new home sales jumped 7.4% to a seasonally adjusted annual rate of 724,000 units in March, a six-month high as buyers rushed to take advantage of a decline in mortgage rates. But the gloomy economic outlook could curb further gains.

Builders are offering incentives, including price reductions, to clear inventory that is at levels last seen during the global financial crisis.

The average rate on the popular 30-year fixed mortgage declined to 6.65% in March from 6.76% at the end of February, data from mortgage finance agency Freddie Mac showed. But the rate has since been rising, touching a two-month high of 6.83% last week on growth and inflation concerns.

The median new house price dropped 7.5% to $403,600 in March from a year earlier. Most of the homes sold last month were below $499,999. The inventory of new homes increased 0.6% to 503,000 units, the highest level since November 2007.

“I would expect that the next movement in home sales will be lower as prospective buyers pull back in the spring amid a jump in mortgage rates and heightened uncertainty,” said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets.

(Reporting by Lucia MutikaniEditing by Alexandra Hudson)