In morning inter-bank trading the shekel was strengthening sharply against both the US dollar and euro. The shekel was 1% down against the dollar at NIS 3.44/$ at its strongest against the US currency in 30 months. Since the start of the war against Iran earlier this month the shekel has gained 3% against the dollar and has strengthened by 8% against the US currency over the past year.

In afternoon inter-bank trading the shekel gave up some of its gains and was trading down 0.14% against the dollar at NIS 3.477/$ and down 0.89% against the euro at NIS 3.98/€.

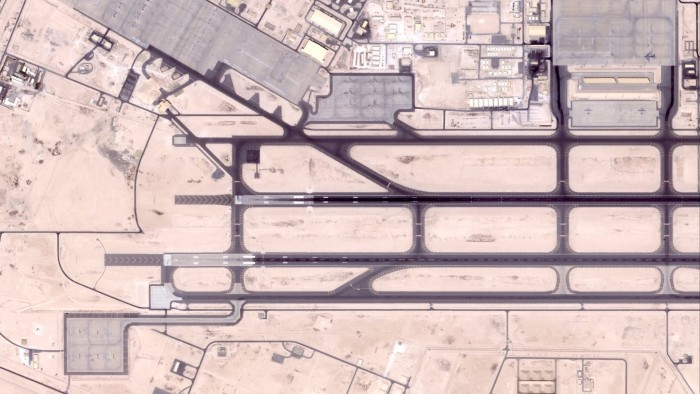

IBI Investment House chief economist Rafi Gozlan says, “The optimism on the stock market comes at least in part from the institutional investors, and they also influence what happens in the foreign exchange market. This is supported by a partial reduction in their exposure to foreign currency. What could complicate things is a situation of increased risk in the world, for example if the Iranians plan to disrupt oil traffic in the Gulf by closing the Straits of Hormuz. This could lead for the most part to the strengthening of the dollar in the world. It could also mean the shekel not strengthening, like with the optimism we have seen on the stock market. That is, we may see a less strong appreciation of the shekel (than could have been expected).”

Gozlan adds, “Most of us were surprised by the optimism there has been on the stock market (since the start of the war with Iran), and there is a line connecting it with the dollar/shekel rate. This is how the market perceives the developments of the end of the war, including a decrease in the risk premium of the Israeli economy. This is deduced by the foreign exchange market as well as in the stock market. I will note that we were surprised by the strength of the increases in the stock market and the currency but not by the direction in which they have gone.”

“Israel’s risk premium continues to fall”

Bank Hapoalim chief financial markets strategist Modi Shafrir tells “Globes,” “In general, we see that Israel’s risk premium continues to fall. Both due to the US attack on Iran’s nuclear sites, and also due to the possibility that the nuclear issue will be removed from the agenda. We see this through the gains in our stock markets on Sunday, alongside an increase in the bond market and also in the strengthening of the shekel against the dollar, as shown by derivatives trading.”

Shafrir sees this bullish trend continuing. “The only thing that could cloud it is a situation in which the global stock markets open with falling prices, due to fears of a war that is expanding in the Middle East, as well as a possible closure of the Straits of Hormuz by the Iranians (which would limit oil tanker traffic). This is perhaps the thing that could cloud the shekel. But in general, it is expected that the shekel will strengthen this morning.”

Sigma Clarity chief investments manager Idan Azoulay adds that shekel strengthening trend began even before the US attack on Iran. He says, “The strength of the shekel was visible long before the US attack on Iran, after, with the exception of a short period when the shekel weakened after the October 7 massacre, it has demonstrated strength for most of the time.”

Azoulay believes, “Assuming that the results of the US attack are positive, we will continue to see foreign investors enter Israel, and the local tech industry will also continue to be responsible for the entry of foreign currency into Israel in what looks like forces that will continue to strengthen the shekel.”

Published by Globes, Israel business news – en.globes.co.il – on June 23, 2025.

© Copyright of Globes Publisher Itonut (1983) Ltd., 2025.