Exclusive: Trump-ally says he is ‘proud to sue’ Powell originally appeared on TheStreet.

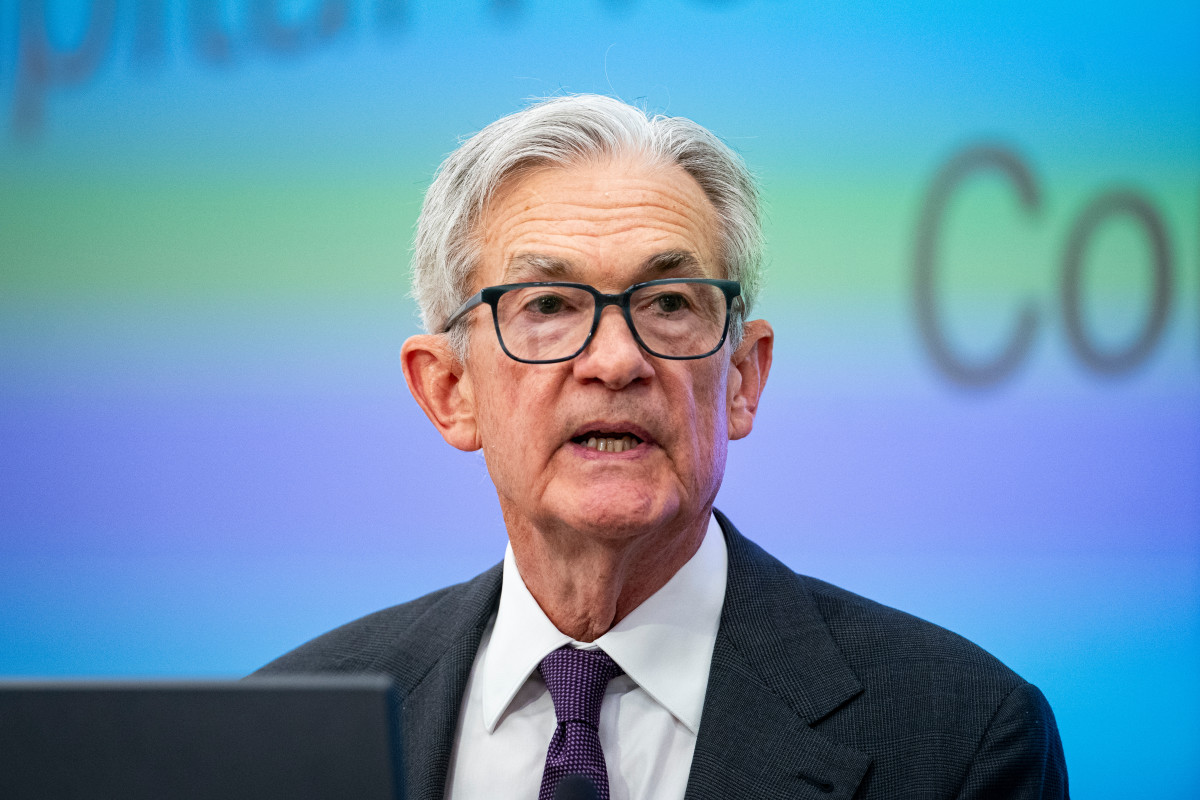

Azoria Capital, a Miami-based investment firm, has filed a federal lawsuit against Federal Reserve Chair Jerome Powell, alleging that the Fed’s closed-door policy meetings violate federal ‘transparency laws’ — and that the decision not to lower interest rates is politically motivated.

The lawsuit, filed on July 24 in the U.S. District Court for the District of Columbia, challenges the Federal Open Market Committee’s (FOMC) practice of holding private deliberations.

Azoria argues these violate the Government in the Sunshine Act, a 1976 law requiring transparency in federal decision-making.

“Azoria is proud to bring this federal lawsuit against Jerome Powell,” CEO James Fishback said in a statement to TheStreet Roundtable. “We are not going to sit idly by and allow Jerome Powell’s Federal Reserve to undermine the duly elected President of the United States and hurt millions of Americans with artificially high interest rates.”

Fed policy shifts ripple across the economy — and crypto markets. Rate cuts tend to boost liquidity and risk appetite, lifting risk assets like Bitcoin. Currently, Bitcoin trades near $119,137.96, up 13% in the past month, per Kraken.

Though Powell has called Bitcoin “digital gold,” he’s emphasized it’s not a rival to the dollar — and that the Fed is barred from holding it directly.

As a result, traders closely monitor every Federal Open Market Committee (FOMC) meeting for clues that could impact pricing, leverage, stablecoins, and valuations across the global crypto landscape.

Join the discussion with CryptosRUs on Roundtable here.

“Inflation is now at a four-year low under President Trump’s leadership,” Azoria CEO James Fishback told FOX Business on July 24.

“Yet Jerome Powell refuses to lower interest rates from a 20-year high. That is a life-altering decision that affects Americans all over the country—from families unable to secure a mortgage to small businesses delaying growth.”

James Fishback has also emerged as a vocal advocate for crypto. In a recent interview, he stated that “the rising economy of crypto lifts all boats,” emphasizing that greater access to digital assets enables Americans to “avoid being debanked” or financially penalized by traditional financial institutions.

Fishback also warned over the broader economic effects of prolonged high interest rates.

“Every percentage point above the natural rate is costing American taxpayers $315 billion a year,” he said. “That’s nearly $3 trillion over the next decade — or $31,000 for every U.S. taxpaying household.”

The Federal Reserve declined to comment when reached by TheStreet Roundtable.

Join the discussion with Scott Melker on Roundtable here.

Azoria Capital has also drawn attention for its ETF, the Azoria 500 Meritocracy ETF (SPXM). The fund tracks companies within the S&P 500 but excludes those with explicit diversity, equity, and inclusion (DEI) hiring mandates.

“We start with the full S&P 500, then kick out companies like Nike, which mandates that 35% of its U.S. corporate workforce must be ethnically diverse,” Fishback added. “Ethnic diversity has nothing to do with selling a pair of running shoes at a profit.”

Fishback, an ardent Trump supporter, also had previously floated the idea of mailing taxpayers $5,000 “DOGE dividend” checks to symbolize the supposed savings from the Department of Governmental Efficiency, briefly led by Elon Musk.

He has also formed the Full Support for Donald, a Political Action Committee to support President Trump.

Exclusive: Trump-ally says he is ‘proud to sue’ Powell first appeared on TheStreet on Jul 24, 2025

This story was originally reported by TheStreet on Jul 24, 2025, where it first appeared.