-

Opendoor Technologies has recently benefited from meme-stock momentum, and the company is gearing up for its Q2 report on Aug. 5.

-

Opendoor has historically seen high levels of valuation volatility following its earnings reports.

-

Factors outside of sales and earnings performance could continue to play big roles in Opendoor’s near-term stock performance.

Opendoor Technologies (NASDAQ: OPEN) stock has taken investors on a wild ride recently, and it has a big test coming up on the near horizon. The company will report its second-quarter report after the market closes on Aug. 5, and results in the period could spur a huge valuation swing for the real estate services specialist.

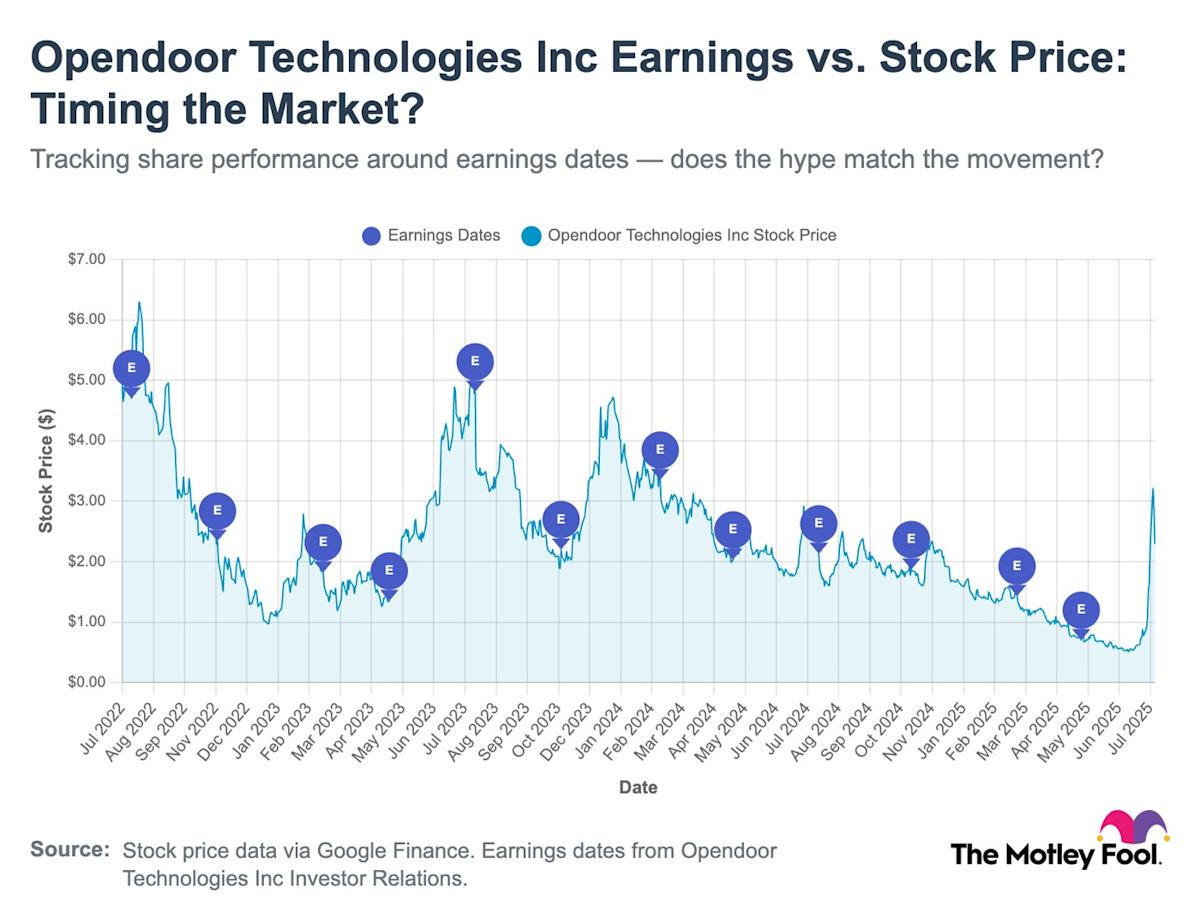

Opendoor’s share price has recently surged thanks to the company becoming a new favorite among meme-stock traders, and it’s still up more than 280% over the last month despite pulling back a bit from its recent high. With the company’s Q2 report on deck, investors may be wondering whether buying into the stock ahead of earnings is a good move. Take a look at the chart below for a snapshot of the stock’s historical performance following its quarterly reports.

Opendoor has historically seen a high level of valuation volatility following its earnings reports. While the company has seen some instances in which its quarterly reports helped power huge gains for its stock, its reports have more frequently corresponded with substantial sell-offs.

Despite its recent meme-stock surge, the company’s share price is still down 12.5% over the last year. Shares are also down roughly 81% over the last five years of trading.

Opendoor’s recent valuation gains have largely been driven by its newfound meme-stock status and appear to be mostly divorced from any fundamental improvements for the business or its outlook. The gains caused the company to delay the vote on a reverse stock split that could have been needed to keep the stock above the $1 per share level needed to remain listed on the Nasdaq stock exchange, but it remains to be seen if its recent surge will hold.

Historically, Opendoor stock has not been a great performer following the company’s earnings reports. On the other hand, that doesn’t provide a clear indication about how the stock will perform after its next report — and unpredictability has only been heightened by the company’s status as a meme stock.

With a forward price-to-sales (P/S) ratio of roughly 0.3, Opendoor is valued at just 30% of this year’s expected sales. The company’s still relatively modest forward P/S ratio does potentially open the door for explosive gains and has helped to make its shares attractive to meme-stock traders.