Give us a general sense of where you see the markets headed right now. We are deeply in oversold territory. Fundamentally, what looks good to you? Do you believe the trend we’ve seen in consumption so far can continue and actually provide a fillip to the market?

Chakri Lokapriya: There are two or three key points. First, with US tariffs now at 25%, export sectors like chemicals and textiles—which were expected to aid earnings growth for the index and the broader economy—are likely to lag. If these tariffs are renegotiated lower, the outlook may improve, but until then, earnings for textiles, jewellery, and pharmaceuticals will remain largely unchanged. Against this backdrop, there are no major catalysts for earnings upgrades, except perhaps from the industrial sector and, to some extent, consumer discretionary.

So, this quarter we might even see a marginal 1–2% earnings decline. Given that, we may see some opportunity in industrials, consumer discretionary, and staples—which seem to be bottoming out, like ITC and Hindustan Unilever. Outside of that, the market doesn’t look particularly exciting.We also had the auto sales data, and we were discussing it with Ashwin. What’s your view on the auto space right now, and do you have any preferred bets?

Chakri Lokapriya: Hero MotoCorp looks oversold from a valuation perspective. Its valuation is fairly attractive. Though the company now ranks third or fourth in market share, behind TVS, we may see some marginal uptick as interest rates come down and we head into the festive season. So, both Hero MotoCorp and TVS Motors look good.

What’s your take on ITC and the kind of numbers we’ve seen, especially in cigarettes and the agri business? Both segments have performed exceptionally well this time.

Chakri Lokapriya: If you look at ITC’s three main businesses—cigarettes, agri, and FMCG—cigarette volume growth was okay at about 5–6%. Pricing was decent, but it wasn’t strong enough to fully offset the margin pressure caused by rising raw material costs for tobacco. So, while the business looks stable, it’s not extraordinary. The FMCG business seems to be bottoming out, which makes valuations reasonable. I’d be an incremental buyer of ITC—it should perform reasonably well.

What do you make of the differing commentaries from L&T and ABB? ABB‘s MD spoke of a cyclical correction in order activity, while L&T was more optimistic about a private capex pickup.

Chakri Lokapriya: Private capex in India should see a marginal pickup, thanks to declining interest rates—which reduce both working capital and capital costs. Capex has been weak for a couple of years, and public capex (both central and state) is expected to rise, helping offset some of the weakness caused by tariffs. Those tariffs were expected to support industrials, but with that support now missing, companies like ABB could face headwinds—hence their cautious tone. L&T, on the other hand, may be focusing more on the long-term private capex revival.

The earnings season so far has been subdued. Other than ICICI Bank and a few midcaps, we haven’t seen many upgrades. Would you agree?

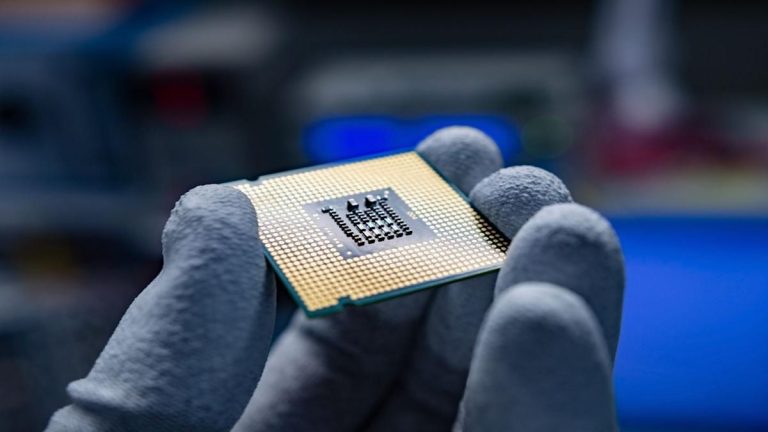

Chakri Lokapriya: You’re absolutely right. Most companies have been waiting for clarity on tariffs and therefore haven’t initiated major plans. Now that we can assume a baseline tariff of 25%, sectors like textiles, gems and jewellery, electronics, and especially chemicals—which were expected to drive exports—are unlikely to see major earnings upgrades. Given this, we might expect Nifty earnings growth of around 6–8%, unless the tariff situation improves for India.

What’s your view on some of the smaller banks? Also, do you prefer sticking with the large-cap names, or would a bottom-up approach work better now?

Chakri Lokapriya: Federal Bank’s results highlight ongoing weakness in the microfinance segment, which may persist into the next quarter. This could lead to some provisioning and slight downward pressure on valuations. That said, valuations are still reasonable. Among large-cap banks, ICICI has posted strong numbers; HDFC’s are steady. Given the current environment, large banks with a wider business spread are preferable.

What’s your assessment of the realty sector? The index was down over 7% last week despite decent earnings, including those from Godrej Properties.

Chakri Lokapriya: The larger macro trend of falling interest rates is favorable for real estate. Many companies have built up a solid inventory pipeline. Pre-sales data across a few names show cautious optimism. However, valuations have already run up quite a bit—Godrej, for example, trades at a significant premium to book value. This suggests limited upside in the near term unless pre-sales data for upcoming quarters shows firm growth.