What is your take on the markets? Are there any pockets where you’re finding strength, even in this kind of market? There’s clearly a lot of sectoral churning underway.

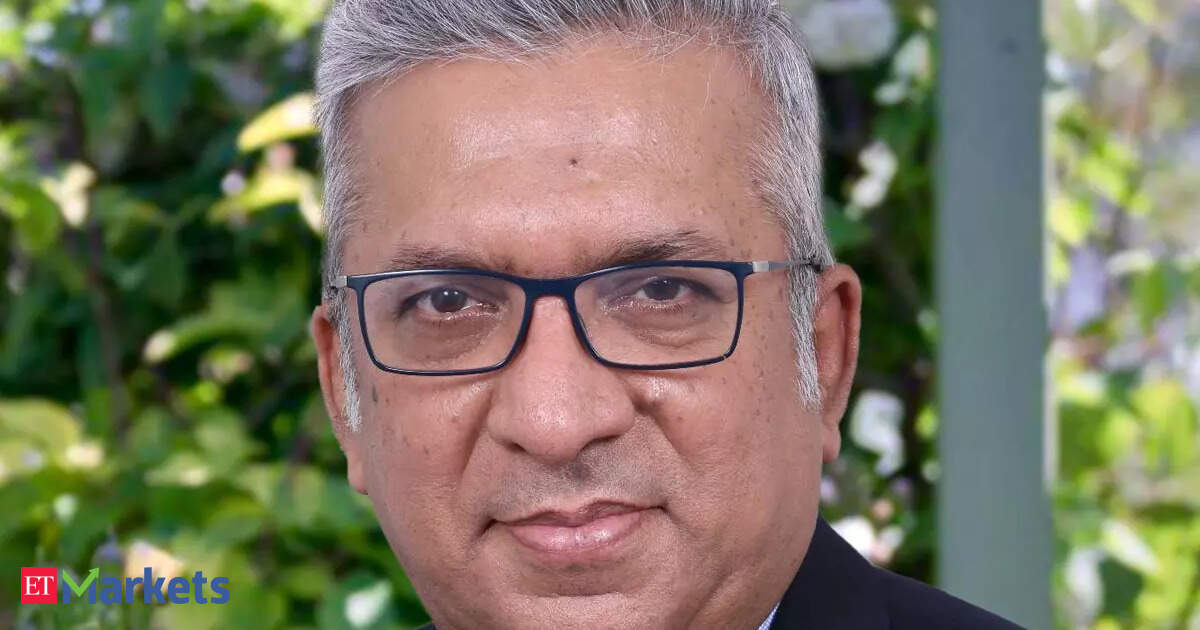

Nitin Raheja: Oh yes, absolutely. When we entered this quarter, expectations were quite low. The belief was that this would be a weak quarter and the ongoing downgrade cycle would likely continue. Now that we’re midway through the earnings season, it hasn’t been as bad as initially anticipated. Whether you look at the IT pack or parts of the banking sector, the results have been better than expected. That’s a positive sign as we look ahead, because the so-called slowdown in the economy may not be as severe as many had feared. This could mean that as we move into the second half of the year, the worst of the downgrade cycle may be behind us, and we might even start to see some upgrades.

Cement was one sector where you were bullish, expecting earnings growth to translate into stock performance. Lately, it seems like cement is the only pack showing resilience. Just look at the moves in stocks like UltraTech, Ramco, Star Cement, even Ambuja and ACC — all are seeing upward momentum in today’s session. What’s your current take on the cement sector? From these levels, what kind of upside do you see for the sector and its stocks?

Nitin Raheja: Most cement companies have reported their best EBITDA per tonne in the past year. This has truly been a fabulous quarter for almost all of them in terms of profitability. While the second quarter is traditionally weak due to the monsoon season, we still expect a strong uptrend for cement companies. This is primarily driven by continued focus on infrastructure spending and capex. In my view, given the current global scenario regarding tariffs and the concerns over domestic consumption slowdown, the government will likely be compelled to revisit its investment plans. That could lead to a further uptick in activity in the second half of the year. So yes, we continue to remain positive on the cement sector.